The Best Gold IRA Companies of 2022

January 14, 2022 - Written by Bill Thompson

Although traditional IRAs have been popular for decades, savvy investors are turning towards alternative assets like precious metals. Gold and silver are a stable form of wealth storage that stocks and bonds can no longer claim to be.

If you're looking to invest in a gold IRA, keep reading for a list of the best companies on the market. These companies have been rated based on customer feedback, business ratings, experience & reliability, and transparency.

Disclosure: We may receive compensation if you purchase through the links on this website. However, this does not affect how much you pay or the integrity of our review. We simply choose the best option for retirees.

#1 Best Prices

Goldco Precious Metals

Rated 4.8/5 Stars Overall

#2 Best Buyback Program

American Hartford Gold

Rated 4.7/5 Stars Overall

#3 Best Client Feedback

Augusta Precious Metals

Rated 4.6/5 Stars Overall

The Top Gold IRA Companies in 2022

Company | Best For | Header |

|---|---|---|

#1 Goldco Precious Metals | Best Business Ratings | |

#2 American Hartford Gold | Best Buyback Program | |

#3 Augusta Precious Metals | Best Client Feedback | |

#4 Birch Gold Group | Best Education | |

#5 Noble Gold Investments | Lowest Minimum |

#1 Goldco

Best Business Ratings & Customer Service

Rated 4.8/5 Stars

Key Features

Based on official business ratings, Goldco is one of the leading gold IRA companies in the US. Aside from their A+ ratings, they also have near-perfect client feedback, white-glove customer service, and a no-pressure sales approach that makes the investing process simple and painless.

As you become an investor with Goldco, you get to work with some of the most knowledgable staff in the US when it comes to precious metal IRAs.

About Goldco Precious Metals

Goldco is our number one gold IRA company choice for many reasons. Their knowledgable staff, experience in investing, and A+ business ratings give investors comfort when transferring something as important as their life savings. They also walk you step-by-step through the rollover and investment process, including the paperwork.

With some of the best client feedback, transparent processes, white-glove customer service, and rational approach to investing, Goldco is a solid choice when considering who to invest with.

Investing in a gold IRA is usually the decision investors come to when they want to protect their assets and hedge against the recession, inflation, and other market risks eroding their savings. Historically, gold has performed opposite the stock market which makes it an excellent hedge in a time like 2022; Goldco makes the investment process simple and easy. They are willing to answer any questions, explain the ins and outs of your investment, and walk you through the entire process. Another great aspect of investing with Goldco is their buy-back guarantee, which takes away any apparent risk factor of your investment.

Who is Goldco Precious Metals Best For?

Goldco Precious Metals is best for investors who:

Fees & Minimum Investment

Minimum Investment

Yearly Fees

Promotions

$25,000

$150-300

Up to $10,000 in free silver

Pros

Cons

#2 American Hartford Gold

Best Buyback Program

Rated 4.7/5 Stars

Key Features

About American Hartford Gold

American Hartford Gold has been successfully serving their customers since 2015. Even though they don't have as many years under their belt as other companies, they have been able to achieve the best brand recognition in the gold IRA industry and deliver of $1 billion in precious metals.

American Hartford Gold is a reputable gold IRA company which has proven itself time and time again. They too have some of the best business ratings, trustworthy executives and brand ambassadors, and still maintain their family-run approach.

They also have an excellent reputation for customer service; their main priority is helping their clients diversify their portfolio and hedge against market risks we all face. They have an excellent buyback guarantee should you decide to change your mind. If you're looking for a family-run gold IRA company with near-perfect ratings, a brand most recognize, and experience with over $1 billion, American Hartford Gold is a great choice.

Who is American Hartford Gold Best For?

Investors looking to work with a family-run company that has reputable endorsers, a quality buyback guarantee, and great business ratings.

Fees & Minimum Investment

Fees:

Minimum Investment:

Not mentioned publicly

$10,000

Pros

Cons

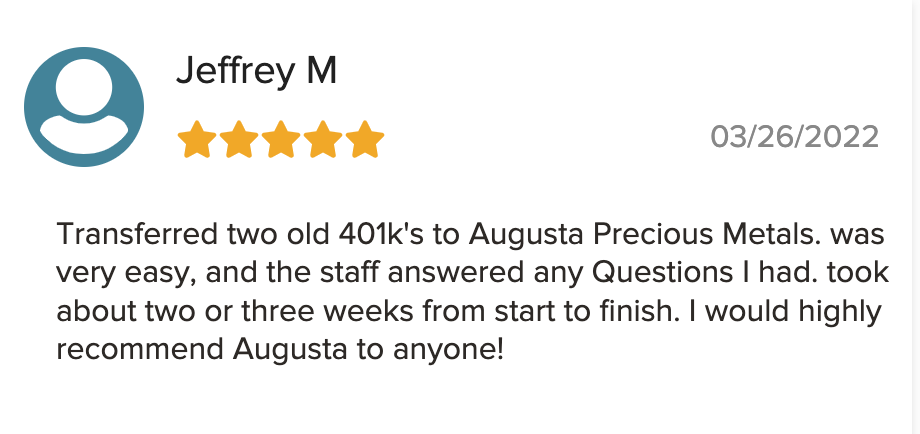

#3 Augusta Precious Metals

Best Client Feedback

Rated 4.6/5 Stars

Key Features

About Augusta Precious Metals

Founded in 2012, Augusta Precious Metals is an industry-leading gold IRA company. Its team of experienced professionals has a proven track record of providing first-rate service to customers.

Augusta Precious Metals offers physical gold and silver IRAs. The company has earned a reputation for providing high-quality customer service and educating its clients with their one-on-one web conference by their Harvard economist.

The company is also known for its easy-to-understand pricing scheme. There are no hidden fees or commissions. Augusta also has an A+ rating with the Better Business Bureau and an AAA rating with the Business Consumer Alliance..

Augusta Precious Metals 5 dedicated teams of employees, each focusing on a different part of the investment process. They walk you step-by-step from start to finish through the investment process and even handle 95% of the paperwork for you.

Who is Augusta Precious Metals Best For?

Americans between 45-65 who have over $100k in retirement savings and a minimum of $50k to put in their gold IRA.

Fees & Minimum Investment

Minimum Investment

Fees:

Promotions

$50,000

$180-$250 per year

Up to 10 years of fees waived

Pros

Cons

#4 Birch Gold Group

Best Education

Rated 4.5/5 Stars

Key Features

About Birch Gold Group

Investing in gold IRAs is an excellent way to diversify your retirement portfolio. However, you need to find the right company to invest your money. You need to make sure the company is reputable and has a good reputation. You also need to check reviews from customers.

Choosing the best gold IRA company requires you to conduct a thorough research. You need to look for a company that provides a wide range of products and services. You need to find a company that can cater to your needs.

You need to make sure that the company has an A+ rating with the Better Business Bureau. You also need to check if the company is licensed in your area. You should also look for the company’s consumer rating, which is the Better Business Bureau’s rating for businesses.

You should also look for a company that offers a range of products, such as silver and palladium. The company should also be able to educate you on the benefits of investing in precious metals.

You should look for a company that offers competitive pricing. The company should also be able to help you understand the rules regarding Precious Metals IRAs.

You should also look for a gold IRA company that offers superior customer support. You should also check for any fees that are required. Typically, the company will charge you a fee for opening an account. The company should also offer an annual fee that is competitive. The company should also have a free information package.

You should look for a gold IRA company that has a low account minimum. You should also look for a company that has low maintenance fees and depositary fees.

Fees & Minimum Investment

Fees:

Investment Minimum:

Not public

$10,000

Pros

Cons

#5 Noble Gold - Lowest Minimum Investment

4.4/5 Rating

- Minimum Investment: $2,000

Investing in precious metals is an effective strategy to diversify your retirement portfolio. It can help protect your portfolio from potential stock market crashes and inflation. Choosing a reliable company to handle your IRA investments is an important step in the process.

The best companies will make funding and managing your gold IRA easy. They will offer informative educational resources, unbiased information about the market, and expert advice. They also have knowledgeable account representatives who can explain the ins and outs of IRA rollovers and gold products.

The company’s website boasts some pretty impressive features. It includes an online registration process for account setup, a free gold IRA guide, and a comprehensive educational resource. It also claims to have the best pricing in the industry.

Noble Gold also offers a gold buy back program. Customers are eligible for a no-obligation gold buyback. The company also has a secure storage facility, which is insured up to $1 billion.

Noble Gold Investments has an A+ rating with the Better Business Bureau. It also has an exclusive relationship with International Depository Services (IDS), which provides a secure storage facility.

The company also has a comprehensive educational resource on gold IRAs, and its agents don’t waste your time with high-pressure sales tactics. They focus on their expertise and professionalism. They also have a minimum gold IRA investment of just $2,000.

The best gold IRA companies offer unbiased information about gold products, and they make it easy to get started. They also provide a simple and painless way to rollover your existing retirement accounts into a gold IRA.

The top companies on our list offer a variety of silver, gold, and palladium products. They also offer expert advice and informative web conferences.

Who is Noble Gold Investments Best For?

Investors with smaller retirement savings or those not ready to put a large portion of their savings in precious metals yet.

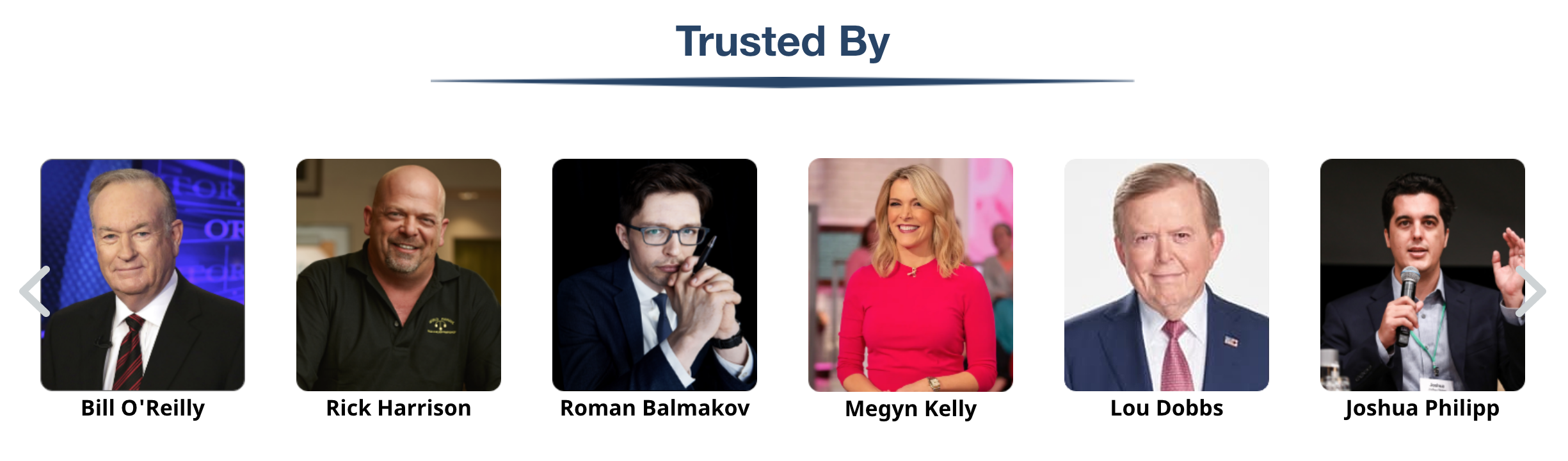

As Seen On....

Gold IRA Rollovers: Understanding the Basics

A Gold IRA (Individual Retirement Account) rollover is a way for individuals to invest in physical gold and other precious metals as a retirement savings vehicle. It involves transferring assets from a traditional IRA or 401(k) into a Gold IRA without incurring taxes or penalties. This allows individuals to diversify their retirement portfolio and potentially protect their savings from inflation and market volatility.

Why Consider a Gold IRA Rollover?

There are several reasons why an individual may choose to do a Gold IRA rollover:

Diversification: Gold has traditionally been a safe haven asset, meaning that its value tends to increase when stock and bond markets are in turmoil. By adding gold to your retirement portfolio, you can potentially reduce the overall risk of your investments.

Protection against inflation: Gold has historically been a good hedge against inflation. As the cost of goods and services increases over time, the value of gold tends to increase as well. This can help protect the purchasing power of your retirement savings.

Tax benefits: Gold IRAs offer the same tax benefits as traditional IRAs. Contributions may be tax-deductible, and any gains in the value of the assets held in the account are tax-deferred until withdrawal.

How to do a Gold IRA Rollover

The process of doing a Gold IRA rollover is relatively straightforward. Here are the basic steps:

Choose a Gold IRA custodian: A Gold IRA custodian is a financial institution that will hold and manage your precious metals. It is important to choose a reputable and trustworthy custodian that is fully licensed and insured.

Open a Gold IRA account: Once you have chosen a custodian, you will need to open a Gold IRA account. This is similar to opening a traditional IRA or 401(k) account.

Transfer assets: You can then transfer assets from your existing IRA or 401(k) into your new Gold IRA account. This can be done through a direct rollover or a 60-day rollover.

Purchase precious metals: Once your assets are in your Gold IRA account, you can then purchase precious metals such as gold, silver, platinum, and palladium. The custodian will store the metals in a secure, insured depository on your behalf.

It's important to note that not all types of precious metals are allowed in a Gold IRA, and there are specific rules and regulations that must be followed. It's always a good idea to consult with a financial advisor and do your own research before making any investment decisions.

Gold IRA FAQ

- What types of precious metals are allowed in a Gold IRA?

Gold, silver, platinum, and palladium are the types of precious metals that are allowed in a Gold IRA. However, not all coins or bars are acceptable. The IRS has strict guidelines on what types of coins and bars are acceptable.

- Are there any age restrictions on a Gold IRA?

There are no age restrictions on a Gold IRA. Any individual under the age of 70.5 with an IRA or 401(k) is eligible to do a Gold IRA rollover.

- How is the value of the precious metals in my Gold IRA determined?

The value of the precious metals in your Gold IRA is determined by the spot price of the metals at the time of purchase. The spot price is the current market price for the metal.

- Are there any restrictions on withdrawing money from a Gold IRA?

There are restrictions on withdrawing money from a Gold IRA before the age of 59.5. This is known as an early distribution penalty

Gold IRA Fees: Understanding the Costs

A Gold IRA (Individual Retirement Account) is a way for individuals to invest in physical gold and other precious metals as a retirement savings vehicle. When considering a Gold IRA, it's important to understand the fees associated with this type of investment. These fees can include setup fees, storage fees, and buy/sell spreads, among others.

Setup Fees

When setting up a Gold IRA, individuals may be required to pay a one-time setup fee. This fee can vary depending on the custodian or broker you choose, but it generally ranges from $50 to $100. Additionally, some custodians may charge an annual account fee, which can be around $75 to $100.

Storage Fees

One of the costs associated with a Gold IRA is storage fees. These fees are for storing the physical precious metals in a secure, insured depository on your behalf. The cost of storage can vary depending on the custodian or broker you choose and the amount of precious metals you hold in your account. On average, storage fees range from $125 to $250 per year, but can be higher or lower depending on the custodian.

Buy/Sell Spreads

Another cost associated with a Gold IRA is the buy/sell spread. This is the difference between the price at which you purchase the precious metals and the price at which you sell them. The spread can vary depending on the custodian or broker you choose, but it generally ranges from 2% to 5%.

Transaction Fees

In addition to the above fees, individuals may also be charged transaction fees when buying or selling precious metals within the account. These fees can vary depending on the custodian or broker you choose, but they can range from $25 to $50 per transaction.

Tax Implications

When investing in a Gold IRA, it's important to understand the tax implications of this type of investment. The IRS has strict guidelines on the types of precious metals that are allowed in a Gold IRA, and there are specific rules and regulations that must be followed.

Capital Gains Tax

When you sell precious metals from your Gold IRA, you may be subject to capital gains tax. This tax is based on the difference between the purchase price and the sale price of the metal. The tax rate is determined by the IRS and can vary depending on the length of time you held the precious metals.

Early Distribution Penalty

There are restrictions on withdrawing money from a Gold IRA before the age of 59.5. This is known as an early distribution penalty. If you withdraw money from your Gold IRA before this age, you may be subject to a 10% penalty in addition to any applicable taxes.

Required Minimum Distributions

Once you reach the age of 70.5, the IRS requires that you take required minimum distributions (RMDs) from your Gold IRA. The amount of the RMD is determined by the IRS and is based on the value of the account and your age. If you fail to take the required distribution, you may be subject to a 50% penalty on the amount not withdrawn.

In conclusion, when considering a Gold IRA, it's important to understand the fees associated with this type of investment. These can include setup fees, storage fees, buy/sell spreads, and transaction fees. Additionally, it's important to understand the tax implications of investing in a Gold IRA, such as capital gains tax, early distribution penalty, and required minimum distributions. It's always a good idea to consult with a financial advisor and do your own research before making any investment decisions.

Gold IRA Age Limits: Understanding the Restrictions

A Gold IRA (Individual Retirement Account) is a way for individuals to invest in physical gold and other precious metals as a retirement savings vehicle. When considering a Gold IRA, it's important to understand the age limits associated with this type of investment. These age limits can include restrictions on contributions and withdrawals.

Age Limits for Contributions

There are no age limits for contributing to a Gold IRA. Any individual under the age of 70.5 with an IRA or 401(k) is eligible to do a Gold IRA rollover. However, there are limits on the amount that can be contributed to a traditional IRA or Roth IRA each year. These limits are set by the IRS and are subject to change.

Age Limits for Withdrawals

The age at which individuals can start taking distributions from a Gold IRA is 59.5. If you withdraw money from your Gold IRA before this age, you may be subject to a 10% penalty in addition to any applicable taxes. Once you reach the age of 70.5, the IRS requires that you take required minimum distributions (RMDs) from your Gold IRA.

Contribution Limits

There are limits on the amount that can be contributed to a Gold IRA each year. These limits are set by the IRS and are subject to change. For the tax year 2021, the contribution limit for traditional and Roth IRAs is $6,000, with an additional catch-up contribution of $1,000 for those who are over 50.

Distribution Rules

When it comes to taking distributions from a Gold IRA, there are specific rules that must be followed. The IRS has strict guidelines on how and when distributions can be taken from a Gold IRA. In general, you can begin taking distributions from a Gold IRA at age 59.5, and you are required to start taking distributions at age 70.5.

Additionally, it's important to note that not all types of precious metals are allowed in a Gold IRA, and there are specific rules and regulations that must be followed. It's always a good idea to consult with a financial advisor and do your own research before making any investment decisions.

Tax Implications

When investing in a Gold IRA, it's important to understand the tax implications of this type of investment. The IRS has strict guidelines on the types of precious metals that are allowed in a Gold IRA, and there are specific rules and regulations that must be followed.

Capital Gains Tax

When you sell precious metals from your Gold IRA, you may be subject to capital gains tax. This tax is based on the difference between the purchase price and the sale price of the metal. The tax rate is determined by the IRS and can vary depending on the length of time you held the precious metals.

Early Distribution Penalty

There are restrictions on withdrawing money from a Gold IRA before the age of 59.5. This is known as an early distribution penalty. If you withdraw money from your Gold IRA before this age, you may be subject to a 10% penalty in addition to any applicable taxes.

Required Minimum Distributions

Once you reach the age of 69.5, the IRS requires that you take required minimum distributions (RMDs) from your Gold IRA. The amount of the RMD is determined by the IRS and is based on the value of the account and your age. If you fail to take the required distribution, you may be subject to a 50% penalty on the amount not withdrawn.

Additionally, it's important to note that the IRS has strict guidelines on the types of precious metals that are allowed in a Gold IRA, and there are specific rules and regulations that must be followed. This can include specific weight and purity requirements for coins and bars, and limits on the types of bullion that can be held within the account.

Rollover and Conversion Rules

When it comes to transferring assets into a Gold IRA, there are specific rules and regulations that must be followed. A direct rollover or trustee-to-trustee transfer is the most common method for transferring assets into a Gold IRA. This allows for a seamless transfer of assets from a traditional IRA or 401(k) into a Gold IRA without incurring taxes or penalties.

Another option is a 60-day rollover, which allows individuals to withdraw assets from their traditional IRA or 401(k) and deposit them into a Gold IRA within 60 days. However, it's important to note that there are limits on the number of 60-day rollovers that can be done per year, and if not done correctly, it can result in taxes and penalties.

Lastly, it's also possible to convert a traditional IRA or 401(k) into a Gold IRA through a Roth IRA conversion. However, it's important to note that this can result in immediate taxes on the converted amount, and it's essential to consult with a financial advisor before making this type of decision.

In conclusion, when considering a Gold IRA, it's important to understand the age limits, contribution limits, and distribution rules associated with this type of investment. Additionally, it's important to understand the tax implications and rollover and conversion rules that come with investing in a Gold IRA. It's always a good idea to consult with a financial advisor and do your own research before making any investment decisions.